What is Currency Pairs

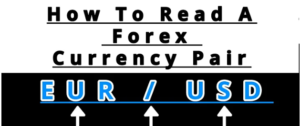

In Forex trading, currencies are always traded in pairs. This is because the value of one currency is determined relative to another currency. The first currency in the pair is called the “base currency”, and the second one is called the “quote currency”. The pair shows how much of the quote currency is needed to buy one unit of the base currency.

How Currency Pairs Are Quoted

In the Forex market, a currency pair is quoted in terms of the ‘base’ and ‘quote’ currency, also known as the ‘counter’ currency. The base currency is the first currency in the pair, and the quote (or counter) currency is the second.

The quoted price shows how much of the quote currency is needed to buy one unit of the base currency. So, if the EUR/USD pair is quoted as 1.1800, it means that you need 1.1800 US dollars to buy one euro.

Bid and Ask Prices

Forex quotes are usually provided with “bid” and “ask” prices. The bid price is the price at which you can sell the base currency, and the ask price is the price at which you can buy the base currency.

For example, if the EUR/USD pair is quoted with a bid of 1.1799 and an ask of 1.1801, you can sell one euro for 1.1799 US dollars, or buy one euro for 1.1801 US dollars.

Pips and Pipettes

A ‘pip’ is the smallest unit of price movement in a forex quote. In most currency pairs, a pip is a movement in the fourth decimal place, or 0.0001. For example, if the price of EUR/USD moves from 1.1800 to 1.1801, that’s a one pip movement.

Some brokers quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places. They are quoting fractional pips, also called ‘pipettes.’ For instance, if EUR/USD moves from 1.18002 to 1.18003, that .00001 USD move higher is ONE PIPETTE.

Spreads

The difference between the bid price and the ask price is known as the ‘spread’. This is essentially the broker’s commission for executing the trade. For example, if the bid price is 1.1799 and the ask price is 1.1801, the spread is 2 pips. The smaller the spread, the less the cost is for you to trade on that pair.

Understanding how currency pairs are quoted is crucial for trading in the Forex market, as it allows you to interpret price movements and calculate potential profits or losses.

Major Currency Pairs

Major currency pairs are the most traded pairs in the Forex market, making up about 80% of the total volume. These pairs all include the US Dollar (USD) on one side and are the most liquid. Examples of major currency pairs include:

EUR/USD (Euro/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

GBP/USD (British Pound/US Dollar)

USD/CHF (US Dollar/Swiss Franc)

Minor Currency Pairs

Minor currency pairs, also known as cross-currency pairs or simply “crosses,” are pairs that do not include the US Dollar. These pairs are less liquid than the major pairs, and they often have wider spreads. Examples of minor currency pairs include:

EUR/GBP (Euro/British Pound)

EUR/AUD (Euro/Australian Dollar)

GBP/JPY (British Pound/Japanese Yen)

Exotic Currency Pairs

Exotic currency pairs consist of one major currency and one currency from an emerging or small economy (e.g., South Africa or Mexico). These pairs are not as liquid as the majors or minors, and they often have even wider spreads. Examples of exotic currency pairs include:

USD/SEK (US Dollar/Swedish Krona)

EUR/TRY (Euro/Turkish Lira)

JPY/NOK (Japanese Yen/Norwegian Krone)

Examples

Let’s say the GBP/USD pair is quoted at 1.3900. This means that 1 British Pound is worth 1.3900 US Dollars. If the quote changes to 1.4000, the Pound has strengthened against the Dollar, because now 1 Pound can buy more Dollars.

Understanding the different types of currency pairs and how they are quoted is fundamental to Forex trading. It’s important to note that different pairs can exhibit different levels of volatility and liquidity, which can impact the potential risks and rewards in trading them.